Connecticut can take a big chunk of your earnings. But at the same time the state is giving back to low and middle income taxpayers.

"I was really surprised. I wasn't expected to get that amount of money," said Nesila Rustemi of Waterbury.

Rustemi is a medical office worker. She's also a full-time student and a full-time mom who qualified for a new state tax credit called the Earned Income Tax Credit.

"I had no idea when I did my income taxes and I knew like 24 hours later when I went to sign the taxes, that's when they told me that you got $1,400 from the state of Connecticut," Rustemi said.

Eligible taxpayers can receive the state credit in addition to the federal earned income tax credit.

"Essentially, it'll give people who would have gotten a very small refund a little bit bigger refund," said Department of Revenue Services Commissioner Kevin B. Sullivan.

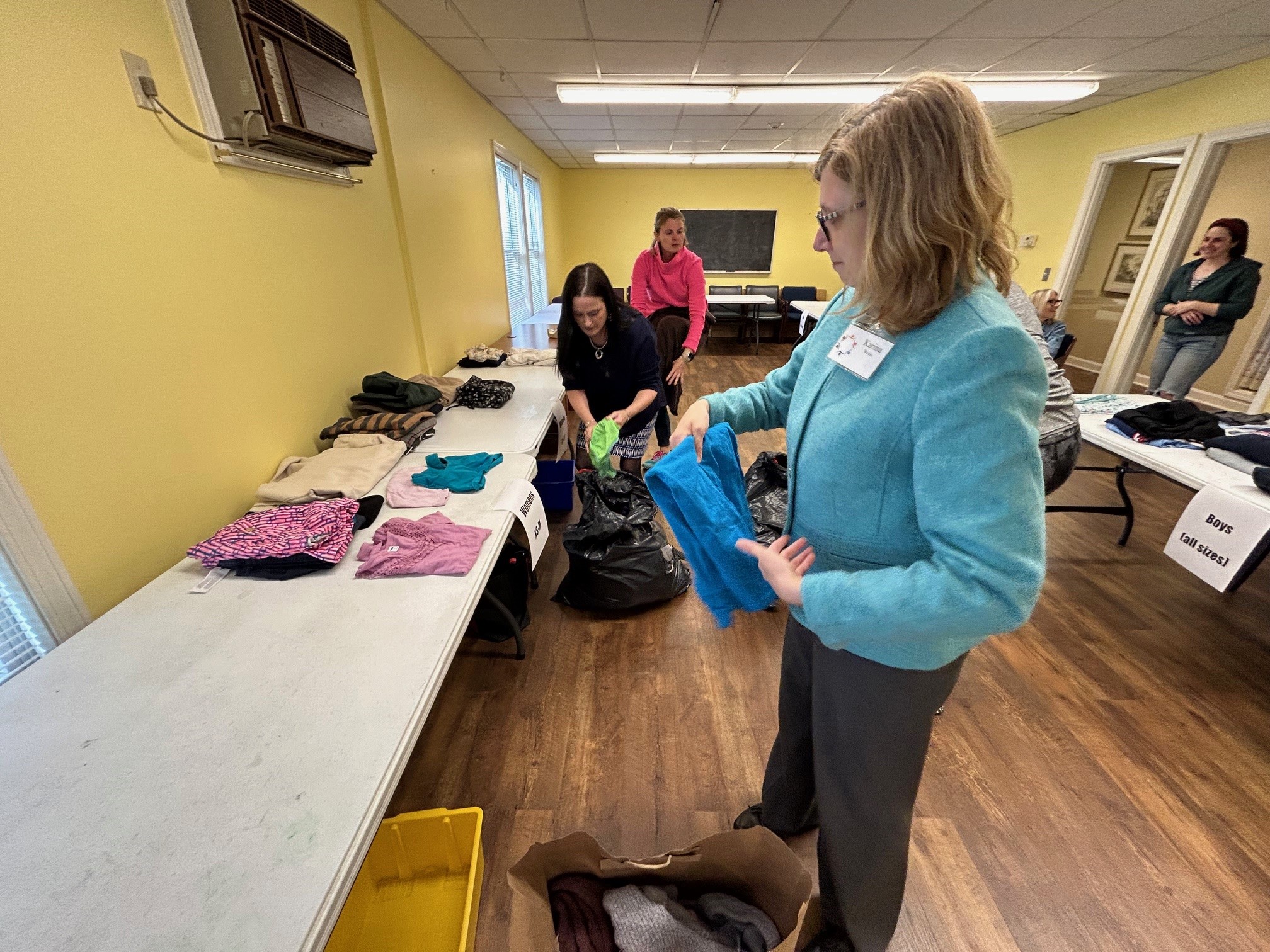

Earned income includes all the taxable wages, salaries and tips you receive from working. If you do not have any tax liability you can still receive the state's new tax credit. The state says free taxpayer services, including Volunteer Income Tax Assistance (VITA), can help taxpayers who want to apply for the EITC.

Local

Tax preparers are seeing lots of individuals who qualify for the combined state and federal credits.

"I have seen clients that come in here that have received the full amount of the federal, which is anywhere up to $5,000, and they walk away with an additional $1,500," said tax preparer William Soldati, who runs the VITA program at Community Action Committee in Danbury.

The state has approved more than 138,000 EITC requests for a total of $89.8 million.

The EITC comes with its own application that you can fill out on your own, but state officials are warning eligible taxpayers not to get taken advantage of by someone offering to fill out your form for a fee.

The Department of Revenue Services also warns taxpayers against falsifying their EITC applications for a chance at more money or having a preparer falsify their records for a higher cut of your refund.

You should also protect your social security numbers to prevent claims being made without your knowledge and never sign a blank return.

See if you qualify for the EITC here.