One of the most rewarding aspects of being a Realtor is being able to call a client and say, “Congratulations, your offer has been accepted - you got the house!” Amy made one of those calls just last night and, even though I was sitting a good four feet away from the phone, I could practically feel the buyer’s excitement. I couldn’t make out the words, but their volume and pitch increased significantly as they celebrated. It’s a very exciting moment.

It’s also the moment when the buyer realizes that they have to start rounding up the money for the purchase. The first deposit is submitted when the offer is accepted, the second deposit is typically due after the inspection contingency has been satisfied, and the remainder of the down payment is due at closing. All of these payments are cold, hard cash, the last two coming in the form of bank checks.

The buyer also has to have money available for closing costs. These cover the attorney fees and prorated expenses like heating oil and property taxes that the seller has paid in advance. It also includes the homeowners insurance that is paid in advance, as well as title insurance premiums for the bank and the buyer. Your agent or mortgage broker will be able to give you approximate closing costs for each house of interest.

Closing costs can be paid in two ways. Bring more cash to closing or accept a credit from the seller and roll the closing costs into the mortgage. Ideally, people would have enough cash to cover both closing costs and their down payments, but that doesn’t always happen in the real world. Sellers may offer closing credits, and buyers can sometimes negotiate them, but the reality is that they result in a higher purchase price. The higher purchase price must be accepted by the bank through an appraisal. And the amount of the credit is typically limited to 3-6% of the mortgage amount, depending on the mortgage type. Ask your mortgage banker for specifics.

The phrase “financing closing costs” is another way to say that they have been rolled into the mortgage. Once in the mortgage, they are charged interest and require regular payments. They are not broken out separately on the monthly statements and are quickly forgotten. However, the impact of financing closing costs can be calculated separately to help think about whether or not it is the right financial decision.

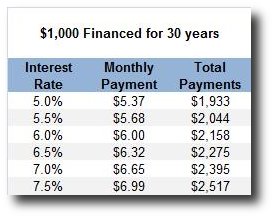

As a simple example, suppose a buyer financed $1,000 in closing costs using their 30 year fixed rate mortgage on which they are paying a 6.0% interest rate. Those closing costs would increase their monthly payment by $6.00 per month, and require total payments of $2,158 over 30 years. The information in the table can be scaled to any closing cost amount. For example, rolling $10,000 of closing costs into a 30 year mortgage at 7% would add $66.50 to the monthly payment and require total payments of $23,950. Just multiply the monthly and total payments by the appropriate factor, in this case 10 ($10,000/$1,000).

The point here is not that financing closing costs is evil and should be avoided like the plague. Although it is more expensive than paying cash, it is a perfectly valid strategy for coming up with the significant amount of up-front money that buying a home requires. And it is often the only viable strategy for younger buyers that have not yet built up enough savings to commit their cash to an illiquid investment.

The key is to understand how financing closing costs will impact the buyer’s overall situation and make sure that it is the right decision. For some buyers the decision is a trade-off between depleting their cash versus making a higher monthly payment. For others it is a choice between buying now versus holding off until the nest egg is a little bigger.

Most importantly, buyers need to plan ahead with their finances so that when they get the call from their agent they can savor the moment…

Congratulations, your offer has been accepted - you got the house!