I had some downtime last night, so I decided to look through the MLS to see how the multi family markets are holding up in the current environment. Although multi family properties can be found throughout the region, they make up a small fraction of the overall residential market in most towns. I started by identifying the towns in which they represent a meaningful portion of the housing stock, which makes the data more interesting and relevant. I settled on Hartford, New Britain, New Haven, and Waterbury as the focus of the research.

All data was pulled from the CT MLS and reviewed and compiled manually. “Distressed” property to me means that either a bank already owns the property or the sale will require lender approval because it is a Short Sale. This analysis does not include properties going through foreclosure if they are not listed in the MLS because there is no central data source which collects that information. And when I say “reviewed manually” that means me going through every single MLS listing for that type of property and counting it manually. The MLS does not require agents to enter in the owner, nor does it require us to enter in a Short Sale, although those data fields do exist. Some agents fill in the information, but most do not, so the easiest way to gather the data is just to look through and manually count. It is not fun, but is doable while sitting on a couch on Tuesday night, watching TV. I counted a property as Distressed if the owner was listed as Corporate or a bank, if the Short Sale field said Yes, or if anywhere in the listing description or agent remarks it said that the sale needed lender approval, was bank owned, or was a short sale.

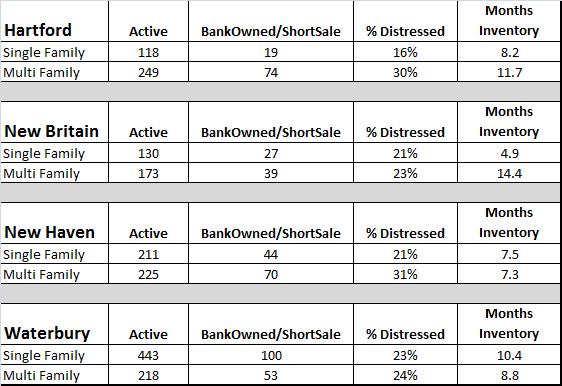

Here’s what I found. Remember, data from the MLS is deemed reliable, but not guaranteed. My ability to count correctly while watching House Hunters is deemed fairly reliable, but also not guaranteed…

Some Observations…

1. The levels of distress among multi family properties is consistently above 20%, and in some cases above 30%. In absolute terms, these numbers are higher than we have seen in previous years and show that the Connecticut’s cities have felt some of the impact of the “housing crisis.”

2. The levels of distress among multi family properties is generally higher than among single families. Unfortunately, the data does not give any clues as to why multi families have become distressed at a higher rate. There are many factors that play into a property owner’s decision to default, but the most likely explanation is that investors took on too much debt to buy marginally profitable properties in hopes of continued price appreciation.

3. Inventory levels vary between the towns. This suggests that there are more buyers shopping in New Haven, where the multi family inventory is 7.3 months, versus Hartford. The other side of the coin is that there may be more opportunities for buyers right now in Hartford.

Connecticut is experiencing distress in its multi family markets, and seeing it at a higher rate than the single family properties in the same markets. This creates opportunities for buyers with cash, whether they are looking for investment properties or plan to live in one of the units themselves. Next month’s market statistics post will include updated data for distress in the single family markets of our usual towns.