Consumer prices continued to rise again in December, although at a slower rate than in November.

The consumer price index, which measures the cost of various goods and services, jumped up another 0.5% on a seasonally adjusted basis in December — a 7.0% increase on a year-over-year basis compared to last December, according to a Labor Department report released Wednesday.

The Bureau of Labor Statistics says that used vehicle prices and shelter were the largest weighted contributors to the latest increase in overall prices, along with household furnishings, apparel and medical care.

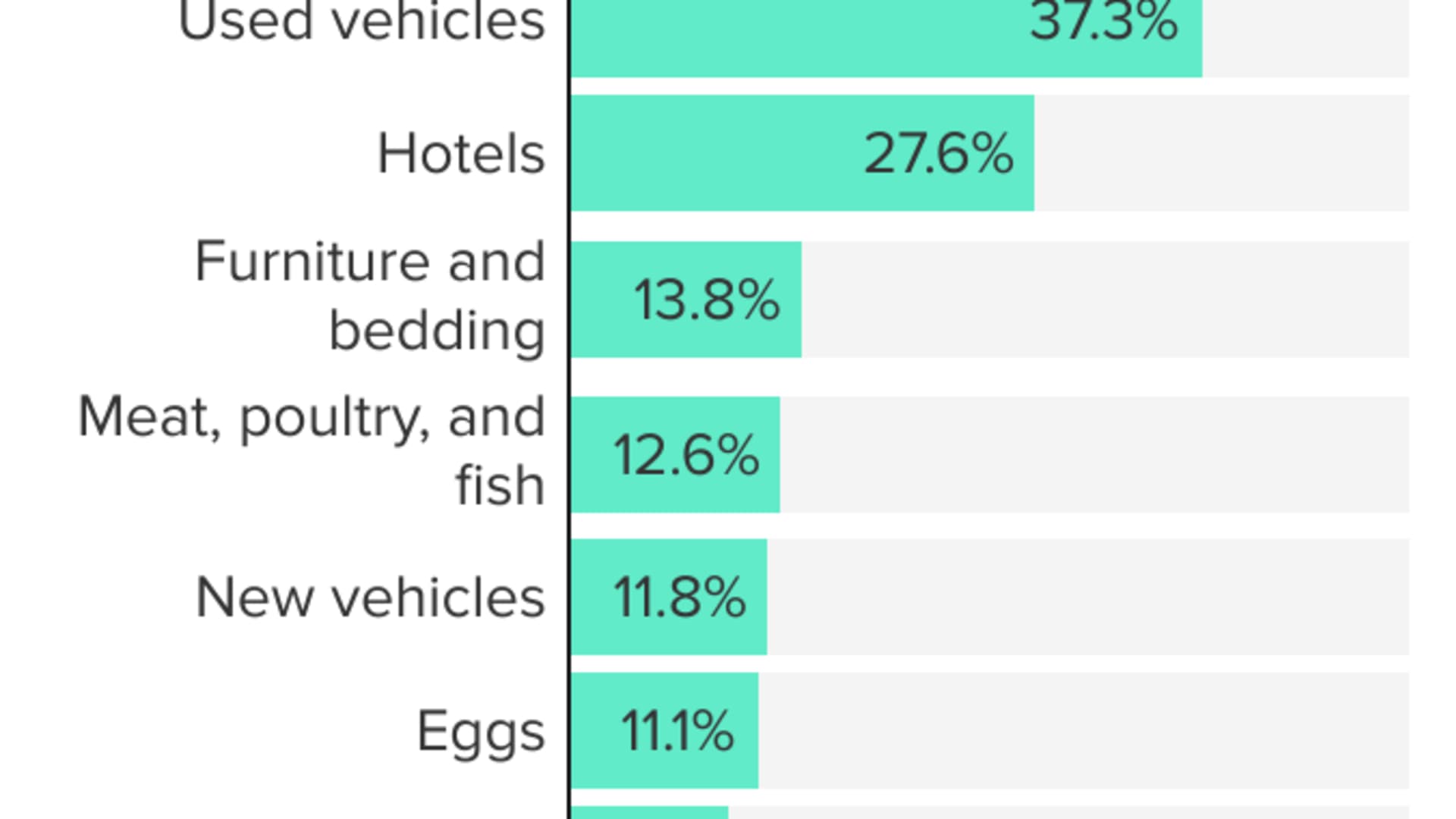

Here's how much consumer prices for various items rose from December 2020 to December 2021, according to data from the U.S. Labor Department:

Get Connecticut local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC Connecticut newsletters.

Energy prices have been big contributors to year-over-year inflation, but they actually declined 0.4% in December — the first decrease since last April. Food prices increased 0.5% in December, but that's less than they'd grown each of the three previous months.

However, inflation continues to grow more broadly. When you take out food and energy prices, which tend to be more volatile in general, consumer prices rose 0.6% in December, following a 0.5% increase in November. This was the sixth time in the last nine months they have increased by 0.5% or more.

Money Report

While energy and food price increases showed signs of slowing down in December, "so-called core prices, which exclude food and energy, increased at the fastest pace in nearly 31 years," says Greg McBride, chief financial analyst at Bankrate. "Core consumer prices are still rising at an outsized pace and have not shown signs of deceleration."

As inflation continues to eat away at consumers' buying power, Federal Reserve Chairman Jerome Powell indicated yesterday that a federal funds rate hike is almost certain in 2022.

Interest rate increases have a "cooling" effect on the economy in that they increase the cost of borrowing, which encourages consumers to spend less.

Don't miss: Here are your new income tax brackets for 2022

Sign up now: Get smarter about your money and career with our weekly newsletter