Younger Americans are paying a lot more in banking fees than older generations, according to a survey from Bankrate.

Gen Z adult checking account holders, ages 18 to 25, pay an average $19 per month in routine service charges, ATM fees and overdraft fees, and millennials, ages 26 to 41, pay $16 per month on average, the survey found. That's compared to $4 for Gen Xers, ages 42 to 57, and $2 for baby boomers, ages 58 to 76.

Younger consumers are also more likely to pay monthly fees, with 47% of Gen Z adults saying they fork over money every month and 35% of millennials saying the same. Meanwhile, only 19% of Gen X and 15% of baby boomer account holders pay monthly fees.

More from Invest in You:

Many Americans aren't optimistic about their finances. Here's why

5 ways to reset your retirement savings and save more in 2022

Here's how to stick to your financial New Year's resolutions

Get Connecticut local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC Connecticut newsletters.

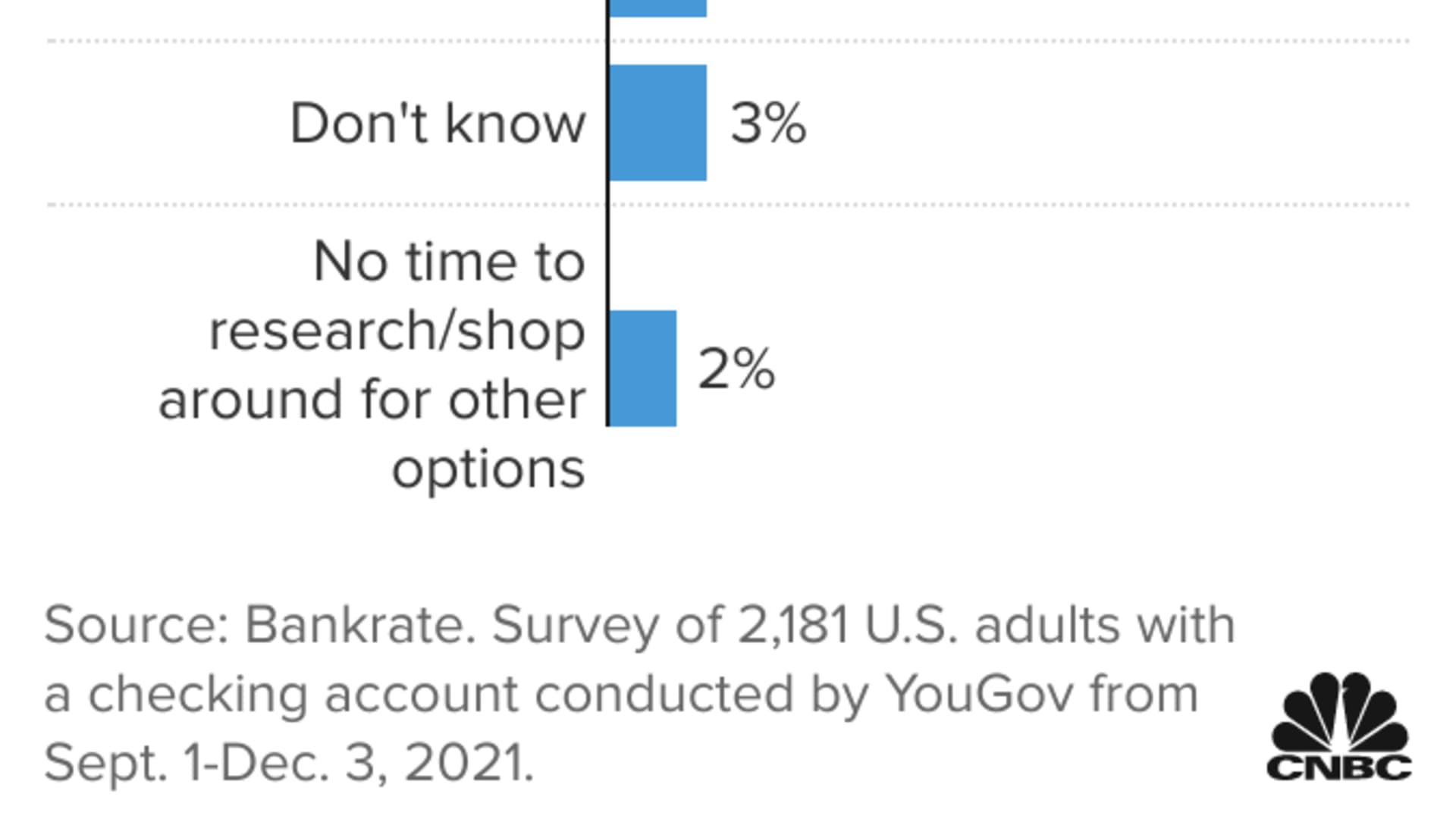

It turns out, ease is more important for younger consumers than the products and services offered by banking institutions. More Gen Z and millennials said they stick with their bank or credit union for convenience compared to Gen X and baby boomers.

Part of the issue is that it takes time to better manage personal finances, said Mark Hamrick, Bankrate's senior economic analyst. It is also an effort to change banks once you already have an account established.

"They are in the early stages of their careers," Hamrick said. "There is a lot going on when one is a younger person, and one is trying to sort things out."

Bankrate, through YouGov Plc, polled 2,725 adults, among whom 2,195 were checking account holders, from Dec. 1 to 3, 2021.

Money Report

While convenience is important, the costs can add up. The average overdraft fee for checking accounts is $33.58, a record high, an earlier Bankrate study found.

The average monthly fee for interest checking accounts is $16.35 and the average balance requirement to avoid a fee is $9,896.81. Meanwhile, nearly half of non-interest checking accounts are free and the average monthly fee is $5.08.

The average ATM fee is $3.08.

Low-cost and no-cost checking accounts are out there, so it can pay to shop around, Hamrick said.

In fact, a majority of Americans have them. Three-quarters are paying nothing and 85% are paying $5 or less per month in fees, according to Bankrate.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version Dinero 101, click here.

CHECK OUT: 4 moneymaking side hustles for introverts: Some projects can bring in hundreds of dollars with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.