Peloton is out with its quarterly report after the bell.

Earlier this week, the company restarted sales of its lower-cost redesigned treadmill after a safety recall in May. The stock has also been under pressure this year with reopening trades taking leadership over stay-at-home plays.

Still, Wall Street is bullish on the name. The stock has 22 buy ratings and just two sells, according to FactSet data.

Get Connecticut local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC Connecticut newsletters.

"How can you not be [bullish]?" Todd Gordon, founder of Inside Edge Capital Management, told CNBC's "Trading Nation" on Thursday before Peloton reported. "People are trying to call the end of this pandemic, and the reality is I think we're going to have to live with this for a while."

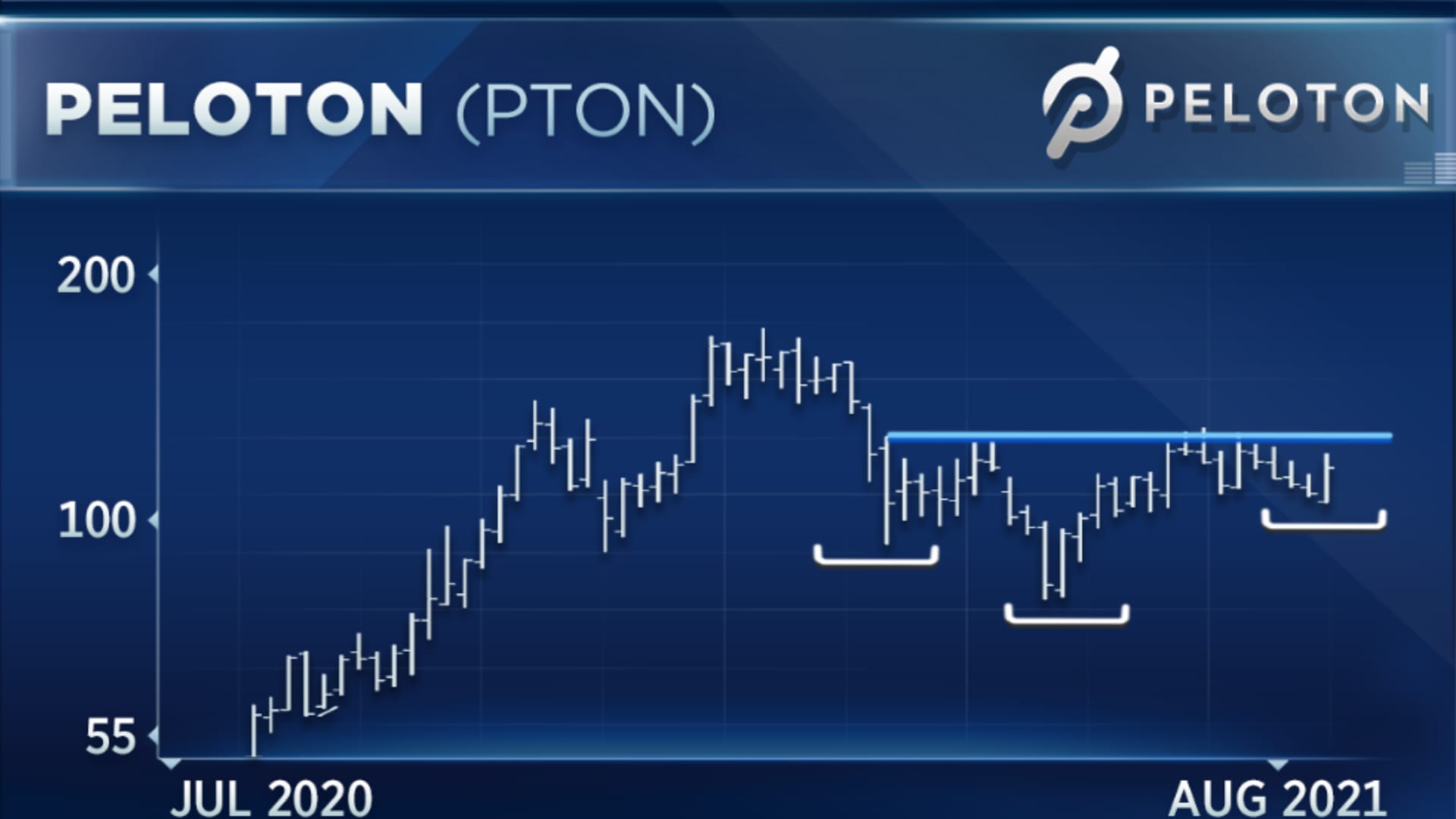

"If you look at the chart heading into earnings tonight, we have sort of an inverse head-and-shoulders, which is a trend continuation pattern. If we get up to $127, I don't see any reason why we can't go back to highs," he said.

Money Report

Peloton traded above $113 on Thursday afternoon. It would need to rally 12% to reach $127 and 50% to reach its old highs above $170, set in January.

But, not everyone has as much conviction in the Peloton stock story. The biggest sticking point is valuation, according to Gina Sanchez, CEO of Chantico Global and chief market strategist at Lido Advisors.

"This stock is clearly priced for huge growth, but really more of a software subscription-type valuation rather than the kind of churn that occurs more sort of in the gym industry," Sanchez said during the same interview. "I just am concerned that where it settles is going to be somewhat lower than expectations."

If users treat the subscription more like a gym membership than a streaming service, Sanchez said, that calls for a lower valuation. She said she will be watching Peloton's churn numbers in this quarter to see if they justify the stock's current price.