- Nearly 4 million children could fall into poverty this month following the end of pandemic-linked monthly child tax credit payments, according to a new analysis from Columbia University.

- That translates into a child poverty rate of roughly 17%, the highest level in more than a year, study estimates. The poverty rate in December – when the final payments were delivered – was 12.1%.

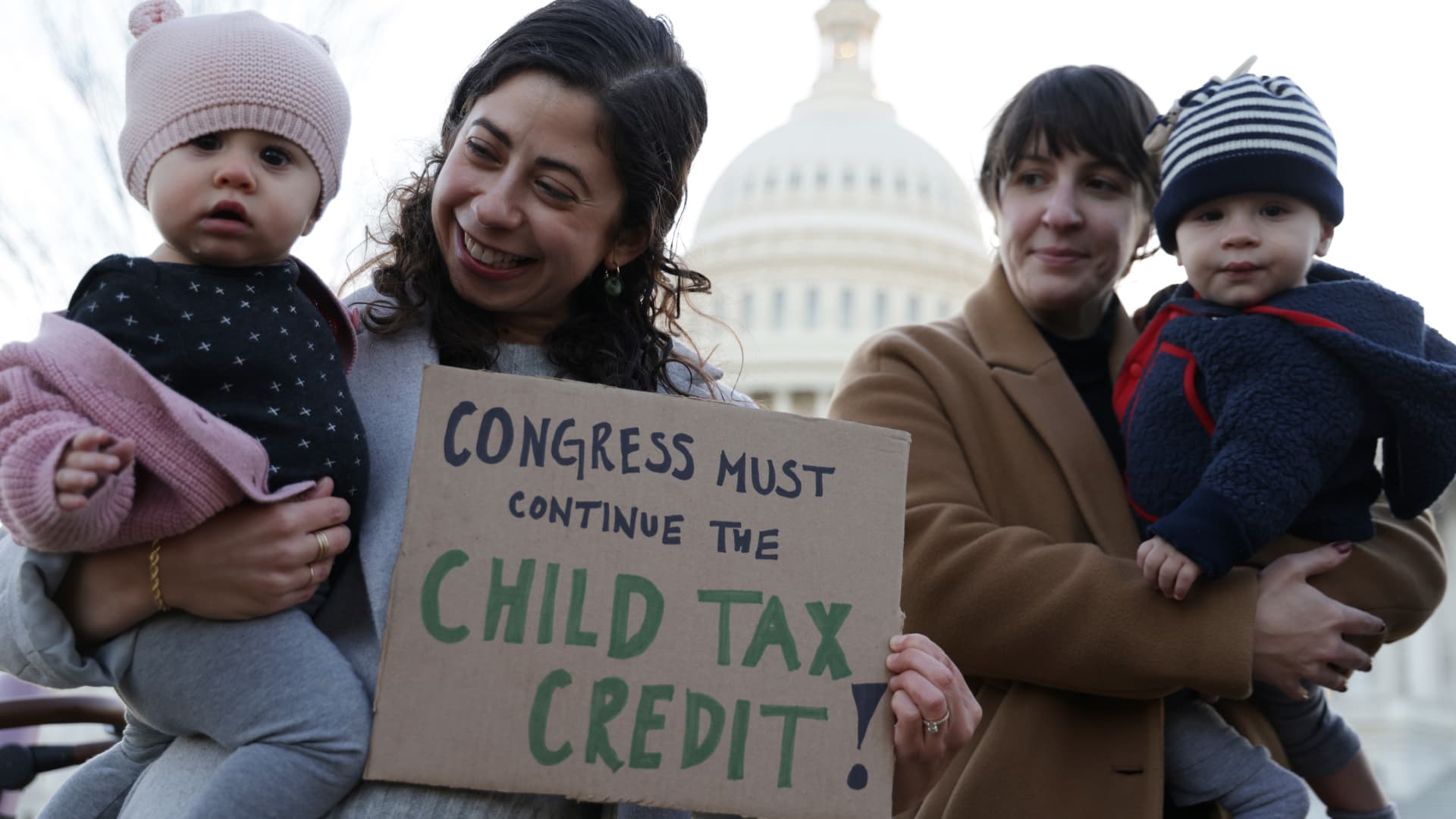

- There is a push to resume the payments, but it has met resistance from Republicans and Sen. Joe Manchin, a conservative West Virginia Democrat.

Nearly 4 million children could fall into poverty this month following the end of pandemic-linked monthly child tax credit payments in December, according to a new analysis from Columbia University.

That will translate to a child poverty rate of roughly 17%, the highest level in more than a year, according to the Center on Poverty and Social Policy at Columbia. The center estimated that the poverty rate in December – when the final payments were delivered – was 12.1%.

Get Connecticut local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC Connecticut newsletters.

The evidence is clear, the report says, "The monthly child tax credit payments have buffered family finances amidst the continuing COVID-19 pandemic."

Democrats expanded the tax credit as part of their nearly $2 trillion Covid relief package last spring. Families received up to $250 a month for children ages 6 and older and $300 a month for younger children. Importantly, parents could get half of their benefit paid in monthly installments in advance of filing their tax return.

The Treasury Department began delivering the monthly checks in July, and many households soon factored the payments into their budgets. The last checks went out in mid-December.

Money Report

"Few federal programs have had such a demonstrable impact in such a short time," Rep. Suzan DelBene, D-Wash., said in a statement Friday. "All this underscores why we need to renew this benefit."

But the measure remains in limbo amid disagreements among Democrats over the broader social spending package and concern from Sen. Joe Manchin, a conservative Democrat from West Virginia, about the long-term cost of the monthly benefit.

Families will still be able to access the second half of their benefit in a lump sum once they file their taxes. Republicans criticized the monthly payments as discouraging work – especially as businesses reported widespread labor shortages.

A recent paper by Rutgers University economist Jacob Bastian found that 413,000 adults would stop working if the monthly credit were extended through this year, most of them mothers. However, he also projected extending it for one year could bring the child poverty rate down to 11%.

The Columbia study found that the scope of the payments expanded, from 59.3 million children in July to 61.2 million by December. It estimates the credit helped keep 3.7 million children out of poverty last month – and all of them are likely to slip back this month without it.

Black and Latino families could bear the brunt of the checks being cut off. Columbia projects the poverty rate among Black children would jump from about 20% in December to more than 25% this month. The rate for Latino children could spike from 17% to 24%.

The report also warns that higher poverty rates can spawn other dangerous side effects.

"In addition to rising monthly poverty, the absence of the child tax credit payments will lead to rising levels of food hardship and declining well-being more broadly in the months to come," it says.