Soon-to-be S&P 500 stock Tesla has rallied nearly 500% this year.

Its run is not yet over, according to Todd Gordon, founder of TradingAnalysis.com. While the stock may now look expensive, he says the market is pricing in explosive growth for the company and the opportunity for more gains.

"If you look at the forward earnings, we're trading 100 times next year's earnings and granted, that's a lot. Trust me, I understand. But I think what people are missing. … I think the pricing mechanism of the market is becoming more efficient. It's hard to put a fundamental valuation and justify what's happening on Tesla now because markets are getting smarter and they're pricing the CEO and the visions of the CEO," Gordon told CNBC's "Trading Nation" on Thursday.

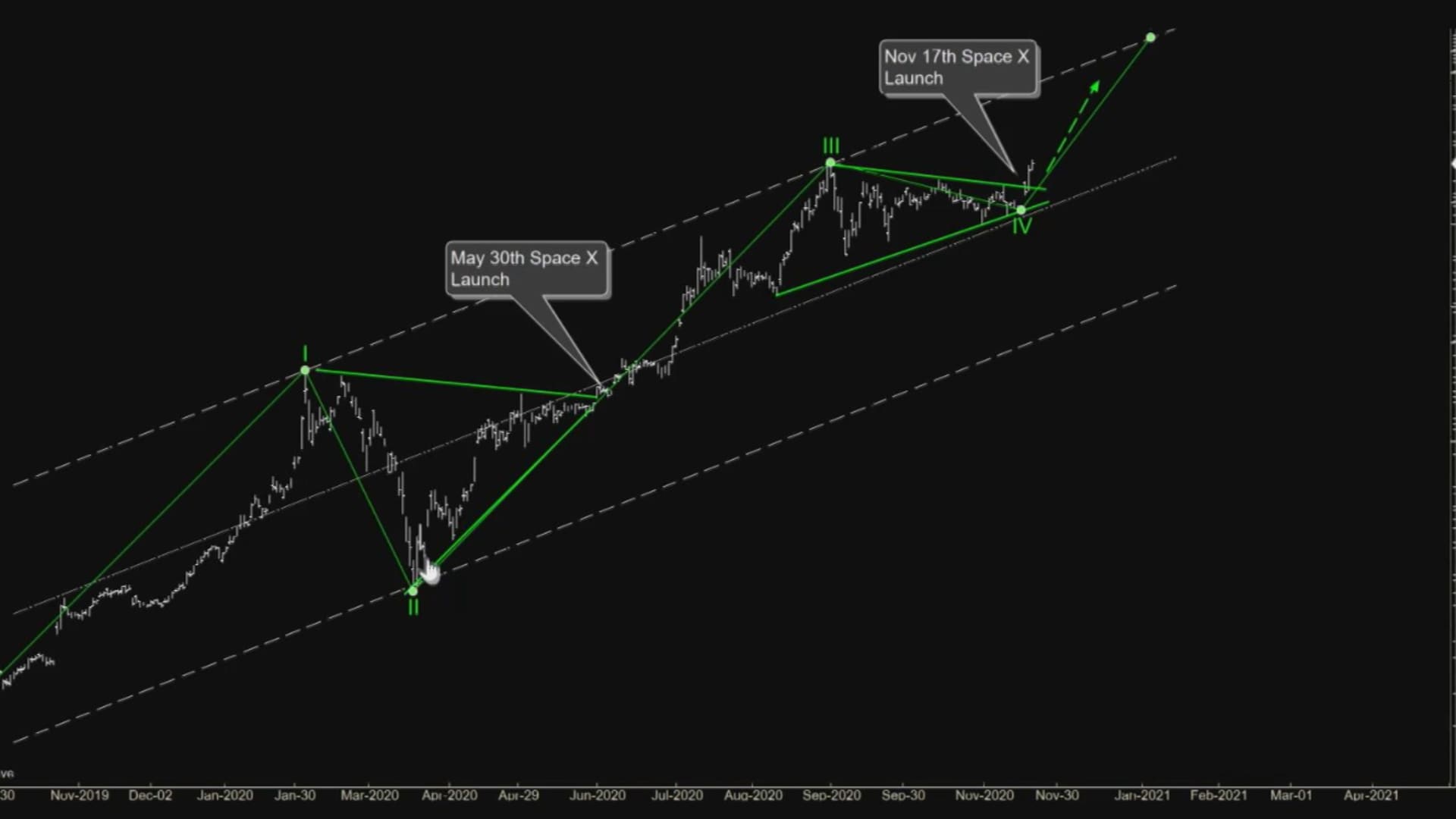

Investors are betting on Tesla's innovations with electric vehicles and CEO Elon Musk's private space exploration company SpaceX, Gordon added. He predicts that SpaceX's satellite coverage and the expansion of 5G could lay way to Tesla's domination of the driverless car market. Proof is in the charts, he said – the last two SpaceX launches unleashed gains for Tesla stock.

Gordon's most recent bet on Tesla paid off. He bought the 450 call with Nov. 20 expiration and sold the 500 call in early October, an options spread that netted him $2,600.

Money Report

Now, Gordon is buying the 550 call and selling the 600 call spread with Jan. 15 expiration, costing $1,300 to potentially make $3,700. A move to $600 implies 20% upside — the stock was trading just below $500 on Friday.

Disclosure: Gordon holds Tesla stock outright in his portfolio.