- President Joe Biden is expected to make a decision on federal student loan forgiveness this month.

- Meanwhile, tuition keeps going up, due, in part, to inflation and other pressures.

- We need to make colleges more affordable, says Temple University President Jason Wingard. Otherwise, "students are going to stop considering higher education as a viable choice, as a valuable choice."

The Biden administration has promised to make a decision on student loan forgiveness within weeks, or even days. And yet, college affordability will remain an issue for years to come, experts say.

Increasingly, high school students are rethinking the value of a four-year degree. Many now say it's just not worth the sky-high cost.

Get Connecticut local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC Connecticut newsletters.

"More and more people are asking 'is college even worth it?'" said Jason Wingard, the president of Temple University and author of "The College Devaluation Crisis."

More from Personal Finance:

College enrollment continues to slide

Inflation is making college even more expensive

Would you be included in student loan forgiveness?

"For 50 or 60 years, it was unquestionable; now, what we're seeing is a flatline," he added. "Higher education — for the first time — has to pivot in order to be relevant."

Money Report

The college system should be more responsive to rapidly evolving needs in the workplace to better position graduates for employment and career success, Wingard argued in his book.

Corporate hiring practices are starting to favor skills over credentials, he said. For higher education, "that means being more applied and not just theoretical." (Some institutions have already slashed the academic programs that were once central to a liberal arts education.)

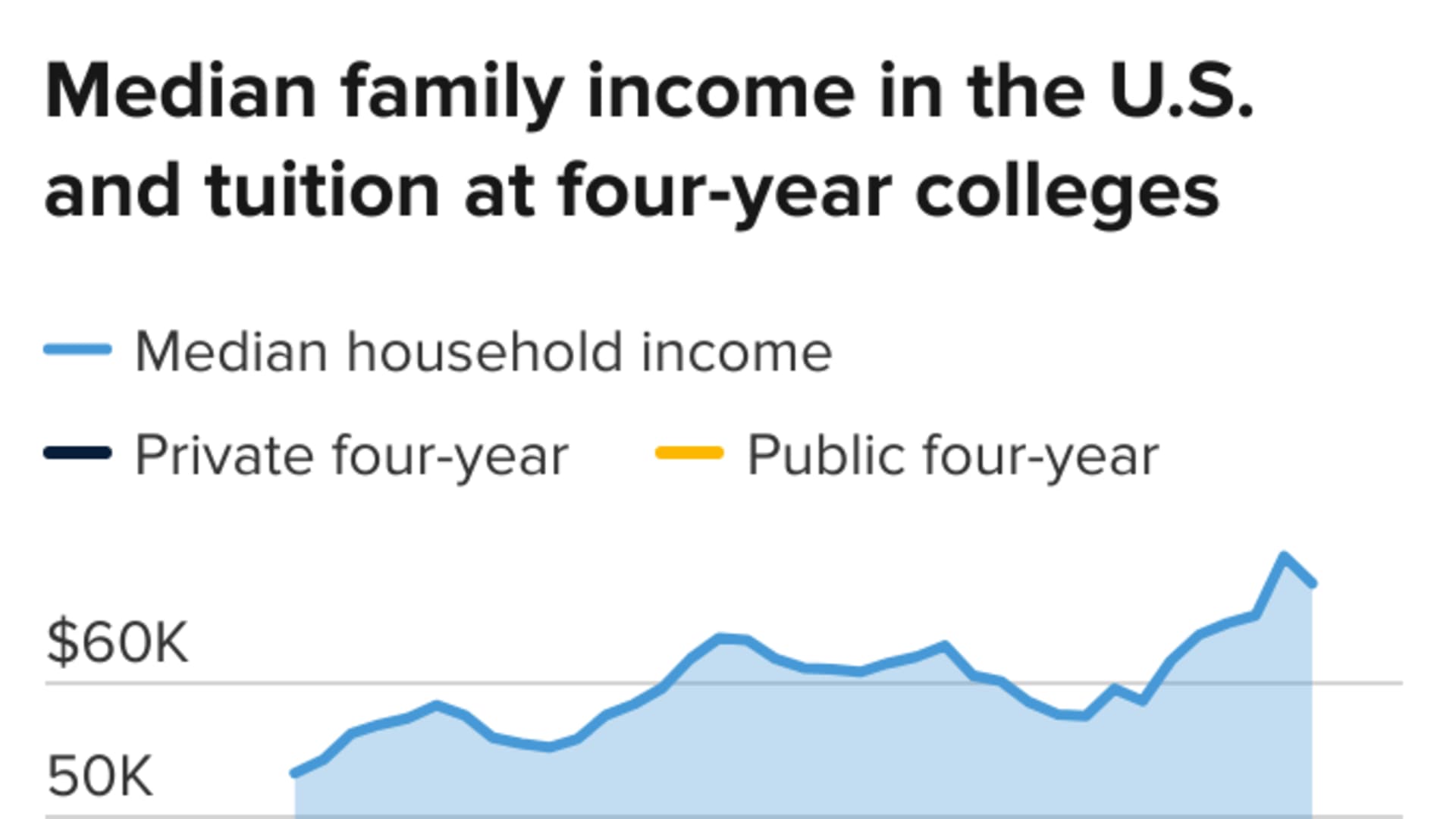

College is only getting more expensive

A college education is now the second-largest expense an individual is likely to make in a lifetime — right after purchasing a home.

But it wasn't always that way.

Deep cuts in state funding for higher education have contributed to significant tuition increases and pushed more of the costs of college onto students, according to an analysis by the Center on Budget and Policy Priorities, a nonpartisan research group based in Washington, D.C.

Schools are under continued pressure cut costs, admit more students who need less aid or raise tuition. This year, some colleges are hiking tuition as much as 5%, citing inflation and other concerns.

"We're not getting more money from the state, and the market wants us to charge less," Wingard said, but "every single cost is going through the roof," he noted, referring to the rising expense of faculty, buildings and maintenance, books and materials, technology and cyber security. "It's impossible to do that."

"We need to make sure education is more affordable for students," he added. "If the government can't help make education more affordable, then students are going to stop considering higher education as a viable choice, as a valuable choice.

"This is a critical time."

"I don't believe that higher education should be this expensive," said Kaya Jones, 23, who graduated from Temple in 2020 with a bachelor's degree in political science and journalism.

To pay for school, Jones worked two jobs and relied on a combination of resources, including contributions from friends and family and student debt.

"It definitely took a whole village," she said.

Jones is now a program coordinator at Ignite, a political leadership program for women, and still owes roughly $35,000 in loans, not including the Parent PLUS loan in her mother's name.

Students want colleges that offer better value

For now, 83% of college students are completely, very or somewhat confident "they will earn enough money to make the cost of college worth it," according to the 2022 College Confidence Index by GradGuard and College Pulse. Parents are less convinced: 63% are confident that a college education will allow their children to get a good job, and only 60% said it is worth the investment.

"Students and their families are prudent to evaluate the return on investment of college like other large consumer purchases," said John Fees, co-founder and managing director of GradGuard, a tuition insurance provider. Further, "this has implications for how institutions operate," he added.

These days, students and parents want to get the best value for their college dollars, according to Eric Greenberg, president of Greenberg Educational Group, a New York-based consulting firm.

"There's much more talk about pre-professionalism," he said.

Along with the cost and academic offerings, families should look at the preprofessional services, alumni networks, job placement and average salary just starting out, as well as 10 to 15 years down the road, he said. Then, Greenberg said, it "becomes less about the name brand."