-

Americans have $1.13 trillion in credit card debt. Here are some expert tips to help pay yours off

Cardholders are carrying more credit card debt than ever before and paying record high interest rates. Here are the best ways to jump-start debt repayment.

-

There's a certain age group that's more likely to carry credit card debt than others

Nearly half of people in a Bankrate.com survey carry credit card debt from month to month. That can cost a lot of extra money at a time when interest rates are very high, and there’s a certain age group that’s more likely to carry that debt.

-

What should I pay off first if I have student loans and other debt?

The average American has more than $92,000 in debt, which includes credit cards, student loans, mortgages and more.

-

What to know about the student loan repayments?

Starting Sept. 1, student loans will continue accruing interest, and monthly bills will start up again in October.

-

54 million Americans have been in credit card debt for at least a year. Here are the best payoff strategies

More cardholders are carrying more credit card debt than ever before, and, on top of that, they’re paying record high interest rates.

-

House Passes Bipartisan Bill to Raise Debt Ceiling and Avert Default

The hard-fought deal pleased few, but lawmakers assessed it was better than the alternative — a devastating economic upheaval if Congress failed to act.

-

Debt Ceiling Talks Make Progress, But House Will Leave Town With No Deal

Congress faces a June 1 deadline to raise or suspend the debt ceiling in order to avoid a catastrophic default.

-

McCarthy Says House Could Vote on Debt Ceiling Deal as Soon as Next Week

“I just believe where we were a week ago and where we are today is a much better place,” said McCarthy, sounding more optimistic than ever about a deal.

-

Biden Administration Has Canceled $66 Billion in Student Debt. How to Know If You Qualify

Under President Joe Biden, the U.S. Department of Education has in recent years canceled more than $66 billion in education debt.

-

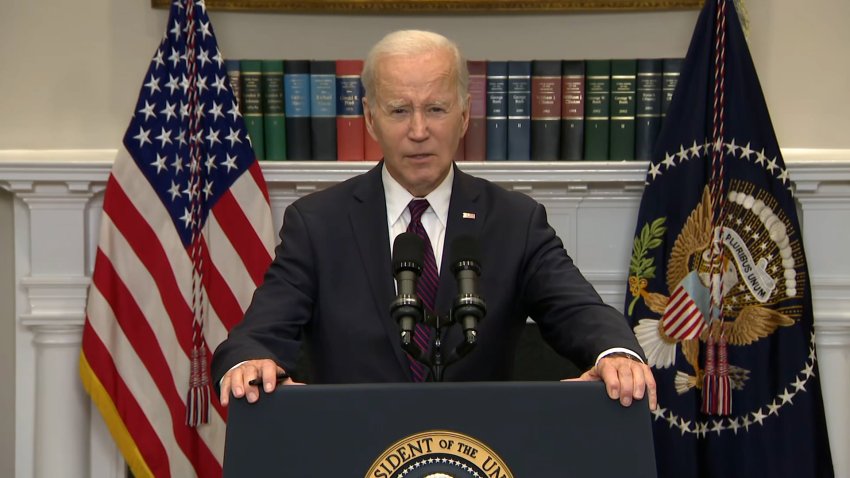

Biden: ‘The United States Is Not Going to Default'

President Biden met with congressional leaders Tuesday to discuss the nation’s debt ceiling in the face of a potential default and economic catastrophe.

-

Connecticut Startup Goodroot Pushes for Measures to Tackle Medical Debt

Tackling medical debt: that is the goal of a startup called Goodroot in Collinsville. Americans have $88 billion in medical debt, according to a February 2022 report from The Consumer Financial Protection Bureau. It impacts nearly one in four people, Lendingtree reports. Now, Goodroot is pushing for measures they say would put the patient first. “We sometimes refer to it…

-

CT LIVE!: Tips to Become Debt-Free

Carmen Perez, CEO of Much Budgeting Platform, shared ways to get on the right track.

-

Conservative Justices Question Biden's Debt Relief Plan, But Appear Skeptical of States' Standing

Biden’s best hope for being allowed to move forward with his plan appeared to be the possibility that the court would find that Republican-led states and individuals challenging the plan lacked the legal right to sue.

-

Supreme Court to Hear Arguments on President's Federal Student Loan Forgiveness Plan

A University of New Haven associate economics professor discusses the impact of the cases before the U.S. Supreme Court and what they could mean for millions of borrowers.

-

How Agencies Are Changing Credit Score Calculations to Improve Access to Credit

A low credit score can hurt your ability to take out a loan, secure a good interest rate, or increase a credit card spending limit. Some reasons for a low score are out of your control — such as unexpected medical debt or a lack of credit history. But credit agencies are working to improve access to credit by giving...

-

The US Has Reached Its Debt Limit. What Happens If It Isn't Raised?

The U.S. government reached the nation’s legal borrowing limit on Thursday, forcing the Treasury Department to resort to “extraordinary measures” to avoid a default.

-

The US Is Hitting Its Debt Limit Today. What Happens If It Isn't Raised?

Economists say consequences of a default on the national debt could include higher interest rates, a stock market crash, a recession and massive job losses. NBC’s Alice Barr reports.

-

Times Are Tough, But Don't Ignore Your Debt

High prices make it easy to reach for a credit card or miss a payment, but experts warn consumers that compounding your debt can make your potentially frustrating and stressful financial situations even worse.

-

Times Are Tough, But Don't Ignore Your Debt

Let’s face it, we’re all impacted by inflation. High prices make it easy to reach for a credit card or miss a payment, but experts warn consumers that compounding your debt can make your potentially frustrating and stressful financial situations even worse. Money Management International (MMI) is one of the organizations that can lend a hand. It’s the largest...