-

Face the Facts: Budget Negotiations to Tackle Topics Including Child Tax Credit, Higher Ed

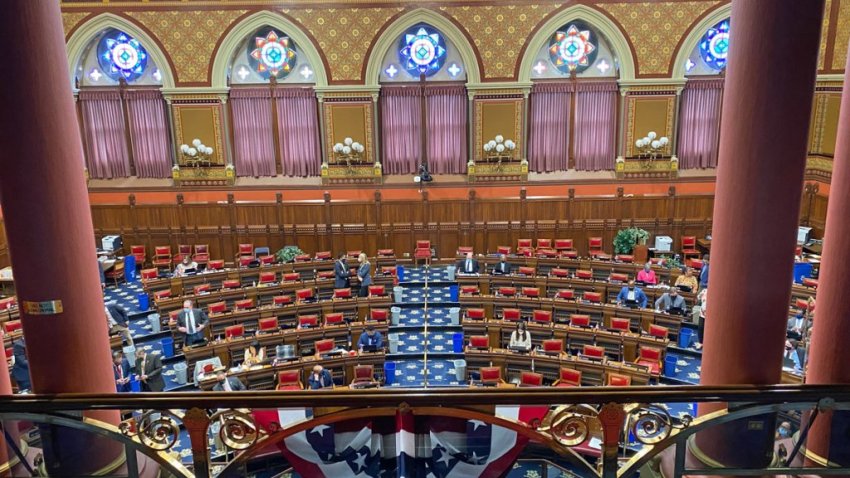

House Speaker Matt Ritter (D-Hartford) talks about the start of budget negotiations. There is debate over funding for higher education and municipalities, plus how much the child tax credit should be.

-