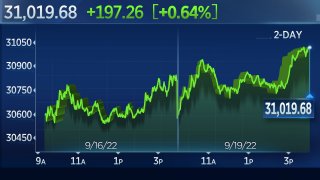

Stocks closed higher on Monday in a volatile trading session ahead of the Federal Reserve's two-day policy meeting slated to kick off Tuesday.

The Dow Jones Industrial Average jumped 197.26 points, or 0.64%, to close at 31,019.68. The S&P 500 gained 0.69% to 3,899.89, and the Nasdaq Composite added 0.76% to end at 11,535.02.

Stock wavered between gains and losses{

Get Connecticut local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC Connecticut newsletters.

Stocks finish Monday's volatile session higher

Stocks seesawed on Monday but ended the session in positive territory as a big Federal Reserve week kicked off.

The Dow Jones Industrial Average closed 197.26 points higher, or 0.64%, to settle at 31,019.68. The S&P 500 jumped 0.69% to 3,899.89 and the Nasdaq Composite gained 0.76% to 11,535.02.

Money Report

— Samantha Subin

Yields pushed higher ahead of the Fed's likely decision to raise its benchmark rate by another 75 basis points to snuff out inflation later this week. The 10-year Treasury yield topped 3.51% and hit its highest level in 11 years{

10-year Treasury yield jumps above 3.5%, hits highest level since 2011

The benchmark 10-year Treasury yield rose to 3.5% on Monday morning, hitting its highest level since 2011 as investors brace for a higher-for-longer period of interest rates amid the Federal Reserve's fight against inflations.

Treasury yields rose above the board last week after the August consumer price index report showed a surprise increase in prices. However, the 10-year largely held near its June highs of 3.495% before taking another leg higher on Monday.

The 10-year last traded at a yield of 3.506%, up nearly 6 basis points. Yields move opposite to price, and one basis point is equal to 0.01%.

— Jesse Pound

After some brief hope over the summer that the Fed may be done with its aggressive tightening campaign, investors have been dumping stocks again on fears the central bank will go too far and tip the economy into a recession.

Investors are focused on the Fed's policy meeting slated to begin Tuesday, where the central bank is expected to raise interest rates by another 75 basis points. Investors are also watching for guidance about corporate earnings before the next reporting season begins in October.

"We're in a wait-and-see approach and markets are waiting for some kind of bullish or bearish catalyst to send us out of this trading range," said Adam Sarhan, CEO of 50 Park Investments. "The markets are struggling for direction and that's the fundamental news."

Nine out of the 11 S&P 500 sectors ended the day positive, led to the upside by materials, consumer discretionary and industrials. Financials also rose as some investors bet{

Stocks waver in volatile trading session ahead of Fed meeting

Stocks seesawed on Monday in a volatile trading session ahead of another key Fed decision later this week.

Many investors are betting on a 75 basis point hike at the conclusion of the central bank's policy meeting on Wednesday — although a 100 basis point increase is not off the table, according to some analysts. The fear is fueling concerns that the Fed won't be able to tame rising prices without steering the economy into a recession.

Amid this backdrop, the S&P 500's financials sector gained 1% as investors bet on higher rates boosting their profit margins. The sector typically benefits in a rising-rate environment since banks and lenders are able to charge more to borrowers.

Industrials and consumer discretionary moved 1% higher.

— Samantha Subin

Vaccine stocks slump as Biden says pandemic is over in TV interview

Vaccine stocks fell on Monday after President Joe Biden said during an interview with CBS' "60 Minutes" on Sunday that the Covid-19 pandemic is done.

"We're still doing a lot of work on it," Biden said. "But the pandemic is over."

Shares of Moderna and Novavax slumped more than 7% each. Pfizer's stock dipped 1.3% while BioNTech shed 8.4%.

— Samantha Subin

Stocks slid last week as investors reacted to a hotter-than-expected inflation report and a dismal warning from FedEx about a "significantly worsened" global economy. The major averages posted their fourth weekly loss in five weeks.

A few economic data releases on deck this week beyond the key Fed meeting, including August housing starts on Tuesday and initial jobless claims on Thursday.

—CNBC's Patti Domm contributed reporting.

Lea la cobertura del mercado de hoy en español aquí.

Stocks finish Monday's volatile session higher

Stocks seesawed on Monday but ended the session in positive territory as a big Federal Reserve week kicked off.

The Dow Jones Industrial Average closed 197.26 points higher, or 0.64%, to settle at 31,019.68. The S&P 500 jumped 0.69% to 3,899.89 and the Nasdaq Composite gained 0.76% to 11,535.02.

— Samantha Subin

Microsoft and more notch fresh 52-week lows

A slew of stocks notched fresh 52-week lows on Monday. That included shares of Microsoft, which traded at levels not seen since May 2021. Seagate and Western Digital traded at lows dating back to January 2021 and October 2020, respectively.

Meanwhile, Constellation Energy's stock hit all-time high trading back to its spin-off from Exelon in January 2022.

— Samantha Subin

Vaccine stocks slump as Biden says pandemic is over in TV interview

Vaccine stocks fell on Monday after President Joe Biden said during an interview with CBS' "60 Minutes" on Sunday that the Covid-19 pandemic is done.

"We're still doing a lot of work on it," Biden said. "But the pandemic is over."

Shares of Moderna and Novavax slumped more than 7% each. Pfizer's stock dipped 1.3% while BioNTech shed 8.4%.

— Samantha Subin

Stocks gain in final hour of trading

Stocks rose as the final hour of trading kicked off on Monday. The Dow Industrial Average last rose 153 points, or 0.48%, while the Nasdaq Composite and S&P 500 gained 0.53% and 0.61%, respectively.

The late-day moves came during a volatile trading session that saw the major averages waver between gains and losses.

— Samantha Subin

Fed raising rates 'will end in tears' for investors, Guggenheim's Scott Minerd says

The Federal Reserve's moves to curb inflation will not end well for investors with long-risk assets, Scott Minerd of Guggenheim Partners said Monday.

Minerd told CNBC's "The Exchange" that the Fed may "overdo it" when it comes to efforts to mitigate inflationary pressures through rate hikes. He expects a .75-point rate hike at the upcoming Fed meeting, with half- and quarter-point hikes coming at the two after.

"They're going to push until something breaks," Minerd said. "I think the break will probably come through, young know, equity prices, but could come in other places, ... could come in the emerging markets. Eventually, this will end in tears."

Read the full CNBC Pro story here.

— Alex Harring

These dividend stocks optimize returns in turbulent times, Morgan Stanley says

Morgan Stanley sees earnings headwinds building and has some dividend stocks for investors to optimize returns despite the volatility.

One top systematic pick from the investment bank is Eastman Chemical. The company has the highest total expected return of 77% on the list, and is expected to have a dividend yield of 3% next year.

Read the full CNBC Pro story here.

— Sarah Min

The market's reaction to last week's inflation report is "pretty normal" if history is any guide, says Oppenheimer's Stoltzfus

If history is any guide, last week's market drawdown is nothing out of the ordinary, Oppenheimer's John Stoltzfus says.

While the firm's chief investment officer believes that markets are oversold following last week's sell-off in reaction to another high core inflation number, it's "pretty normal" when compared to data from previous central bank tightening cycles, he said in a note to clients.

"Taken in context of the degree of the Federal Reserve Board's pivot at the end of last year, their efforts taken since ... and with consideration of historical context of past Fed tightening periods — we are of the view that the equity market's reaction to the higher than expected core inflation number last week was pretty normal," he wrote.

Over the last 32 years, the S&P 500 has shed 7% or more only 24 times, according to Oppenheimer's analysis. During those dips, the benchmark index suffered a negative annual return in just nine of those years.

"We should note that the market appears to be oversold as the forward multiple of the S&P 500 is now back near to where it was before the market hit its low on June 16, prior to its summer rally," Stoltzfus said.

— Samantha Subin

Stocks making the biggest moves midday: Homebuilder stocks, Coinbase and Wix

These are some of the stocks making the biggest moves during midday trading on Monday:

D.R. Horton, Lennar, PulteGroup — Homebuilder stocks rose on Monday after KeyBanc double upgraded the sector to overweight from underweight. Shares of Lennar rose about 2%, while D.R. Horton gained over 2%, and PulteGroup jumped nearly 4%.

Coinbase — Shares of the cryptocurrency exchange fell more than 7% as the price of bitcoin dipped to its lowest level since June and traders continued unwinding short positions following the completion of the Ethereum merge.

Wix — Shares of Wix soared 11% after activist investor Starboard Value revealed a 9% stake in the web development platform company.

Read the the full list of stocks here.

— Michelle Fox, Samantha Subin

New 52-week lows include Walgreens, Hasbro

At least 24 S&P 500 companies hit fresh 52-week lows on Monday, including Walgreens Boots Alliance. The healthcare stock fell more than 1% on Monday to levels not seen since October 2020.

These stocks also notched 52-week lows on Monday:

- Charter Communications trading at lows not seen since March 2020

- Lumen Technologies trading at lows not seen since November 2020

- Garmin trading at lows not seen since May 2020

- Hasbro trading at lows not seen since August 2020

- Mohawk Industries trading at lows not seen since October 2020

- VF Corp. trading at lows not seen since April 2013

- Church & Dwight trading at lows not seen since June 2020

- Bio-Rad Laboratories trading at lows not seen since June 2020

- Charles River Laboratories trading at lows not seen since July 2020

- Hologic trading at lows not seen since June 2021

- Organon trading at lows not seen since June 2021

- PerkinElmer trading at lows not seen since May 2021

- STERIS trading at lows not seen since June 2021

- Bio-Techne trading at lows not seen since December 2020

- Teleflex trading at lows not seen since September 2017

- Viatris trading at lows not seen since December 2008

- West Pharmaceutical Services trading at lows not seen since March 2021

- Allegion trading at levels not seen since April 2020

- Generac trading at lows not seen since October 2020

- Fidelity National Information Services trading at lows not seen since May 2017

- LyondellBasell trading at lows not seen since November 2020

- Digital Realty Trust trading at lows not seen since March 2020

- Weyerhaeuser trading at lows not seen since December 2020

— Samantha Subin

A retest of June's lows isn't out of the question, Oanda's Moya says

A retest of June's lows isn't entirely out of the question if the Federal Reserve stays aggressive in its fight to curb rising prices, Oanda's Ed Moya says.

"Pessimism for equities remains elevated as the US economy appears to have a one-way ticket towards a recession as the Fed is poised to remain aggressive," Moya wrote in a note Monday. "The risks for a retest of the summer lows could easily happen if the Fed remains fully committed with their inflation fight.

He added that the difficult backdrop, coupled with fears of slowing global growth and further cuts to guidance, creates a tough environment for purchasing stocks.

— Samantha Subin

Stocks waver in volatile trading session ahead of Fed meeting

Stocks seesawed on Monday in a volatile trading session ahead of another key Fed decision later this week.

Many investors are betting on a 75 basis point hike at the conclusion of the central bank's policy meeting on Wednesday — although a 100 basis point increase is not off the table, according to some analysts. The fear is fueling concerns that the Fed won't be able to tame rising prices without steering the economy into a recession.

Amid this backdrop, the S&P 500's financials sector gained 1% as investors bet on higher rates boosting their profit margins. The sector typically benefits in a rising-rate environment since banks and lenders are able to charge more to borrowers.

Industrials and consumer discretionary moved 1% higher.

— Samantha Subin

Stock market may be oversold, strategists say

The late morning recovery for stocks on Monday could be a sign that the market is oversold after last week's steep declines.

RBC's Lori Calvasina said in a note to clients on Sunday that growth stocks have been pulling back since being overbought in mid-August but that shift could be nearing the end of the road.

"Increased hawkish rhetoric from the Fed, a move up in the 10-year yield, and last week's CPI print were the triggers for the underperformance we've seen in Growth recently, but the stretched positioning made this segment of the market vulnerable to these negative catalysts. While it's too early to say that Nasdaq positioning has bottomed (it's still a bit above historical lows), it's important to note that the unwind does appear to be later-innings based on what we are seeing in this data," Calvasina wrote.

And at Oppenheimer, John Stoltzfus said in a note that market valuations show it might be time for the selling to pause.

"We should note that the market appears to be oversold as the forward multiple of the S&P 500 is now back near to where it was before the market hit its low on June 16, prior to its summer rally," Stoltzfus wrote.

— Jesse Pound, Michael Bloom

U.S. homebuilder sentiment falls

The National Association of Home Builders/Wells Fargo Housing Market index fell three points in September to 46, marking the ninth straight month of declines.

It's a sign that homebuilders are losing confidence in the market as mortgage rates rise and shows a stark drop from sentiment hovering at 83 in January.

Any reading below 50 is considered negative.

— Samantha Subin, Diana Olick

Consumer discretionary stocks move higher

Despite Monday's continuation of last week's sell-off, the S&P 500's consumer discretionary moved slightly higher amid gains from cruise and travel stocks.

Shares of Norwegian Cruise Line, Royal Caribbean and Carnival rose 1.2%, 3.1% and 2.3%, respectively. Marriott, Hilton and Wynn Resorts also added more than 1% each, along with airline stocks United, Delta and JetBlue. American Airlines gained 2.8%.

— Samantha Subin

Stocks open lower on Monday

Stocks opened lower on Monday as rates surged ahead of the Federal Reserve's policy meeting slated to commence Tuesday. The Dow Jones Industrial Average was last down 187 points, or 0.61%. The S&P 500 slid 0.6% and the Nasdaq Composite toppled 0.57%.

— Samantha Subin

Bitcoin drops 5% to its lowest level in 3 months

Bitcoin fell to its lowest level in three months on Monday as investors dumped risk assets amid expectations of higher interest rates.

The world's largest cryptocurrency dropped 5% to an intraday low of $18,276, reaching its lowest level since June 19. Bitcoin is down 7.2% this month and on pace for the second straight negative month after plunging 15% in August.

— Yun Li

A 12-year mantra for stocks is coming to a close, Morgan Stanley says

A tougher policy stance from the Federal Reserve is putting a damper on a 12-year-long Wall Street mantra, according to Morgan Stanley.

Over the last 12 years, "it was common to hear some variation of 'TINA' (There Is No Alternative), the idea that one needed to be long stocks and bonds because cash offered so little," wrote Morgan Stanley's Andrew Sheets in a note to clients. "Low yields were not the primary reason why stocks rallied over that time; global equities and global equity earnings simply rose by the same amount (~100%)."

Now, that narrative is shifting as the central bank tightens monetary policy and investors have a slew of higher-yielding and lower-volatility offerings they can buy, including cash and short-term fixed income securities.

Sheets believes investors are adapting to a new normal with a less friendly Federal Reserve that looks far from a pivot and is unlikely to take an easy policy stance during difficult times ahead.

"The market is still facing late-cycle conditions: inflation that is too high, policy that is tightening, a yield curve that's inverted, and a slowdown in growth that is ahead not behind," he wrote.

— Samantha Subin

Goldman cuts GDP outlook, forecasts higher chance for recession ahead

Goldman Sachs sees higher interest rates, lower growth and elevated risks of a recession ahead.

The Wall Street firm over the weekend cut its GDP forecast for 2023 and now sees growth of just 1.1% for the year, down from the previous expectation of 1.5%.

That dovetails with an increase in its expectations for Federal Reserve interest rate hikes, which it sees totaling 1.75 percentage points through the end of the year as the central bank looks to bring inflation under control.

"This higher rates path combined with recent tightening in financial conditions implies a somewhat worse outlook for growth and employment next year," economist Joseph Briggs wrote in a client note dated Friday evening.

Goldman also now expects the unemployment rate to rise to 4.1% by the end of 2023, from its current level of 3.7%, and to 4.2% by the end of 2024.

Taken together, the firm sees the tighter financial conditions boosting the probability of recession over the next 12 months to 35%.

—Jeff Cox

A 100 basis point hike would 'unnerve' Wall Street, says CFRA's Stovall

Hiking rates more than the anticipated 75 basis points could distress Wall Street and up the chances of overtightening, CFRA's Sam Stovall said.

"We think a 100 bps hike would unnerve Wall Street, as it would imply that the FOMC is overreacting to the data rather than sticking to its game plan, and would increase the likelihood that the FOMC will eventually overtighten and lessen the possibility of achieving a soft landing," he wrote in a note to clients Monday.

Of the 56 rate hikes that have occurred since World War II, the central bank has upped interest rates by 100 basis points only seven times.

Following those hikes, the S&P 500 recorded average returns of -2.4%, -1.3%, and 0.1% over respective one, three and six-month periods, he added

— Samantha Subin

10-year Treasury yield jumps above 3.5%, hits highest level since 2011

The benchmark 10-year Treasury yield rose to 3.5% on Monday morning, hitting its highest level since 2011 as investors brace for a higher-for-longer period of interest rates amid the Federal Reserve's fight against inflations.

Treasury yields rose above the board last week after the August consumer price index report showed a surprise increase in prices. However, the 10-year largely held near its June highs of 3.495% before taking another leg higher on Monday.

The 10-year last traded at a yield of 3.506%, up nearly 6 basis points. Yields move opposite to price, and one basis point is equal to 0.01%.

— Jesse Pound

S&P 500 could retest bear market low, chart analysts say

Chart analysts think the S&P 500 looks increasingly set for a retest of the bear market low, as Wall Street enters a potentially volatile week with a looming Fed meeting.

"We've sided with a higher low in the S&P 500, and believe a 'less intense' lower low has become more likely following rollovers in select mega-cap stocks," Oppenheimer's Ari Wald wrote. "The crux of our view is that mega-cap weakness is masking improving breadth which we think bottomed in June."

The S&P 500 hit a closing low of 3,666 in mid-June.

CNBC Pro subscribers can read more here.

— Patti Domm, Fred Imbert

Adobe shares slide after Wells Fargo downgrade

Wells Fargo downgraded Adobe shares to equal weight from overweight, sending the stock down more than 1% in premarket trading.

"Following a string of disappointing earnings results, Adobe shocked the software world announcing its intent to acquire Figma for ~$20Bn (1/2 cash, 1/2 stock)," Wells Fargo wrote. "While the product/strategic fit is clearly aligned, it's the price tag that is likely to lend credence to the bear case, at least for now."

CNBC Pro subscribers can read more here.

— Sarah Min

CNBC Pro: This ETF carries risk — but outperforms when volatility spikes

As volatility rears its head once again, investors looking for a short-term trade could opt for this ETF with a track record of outperformance in times of extreme market moves.

"It is probably the prospect of very quick and sizable gains when everyone else in the market seems to be losing their shirts that I believe is appealing about this fund," Daniel Martins, head researcher and portfolio strategist at DM Martins Research, said.

Yet, despite the potential for high returns, the ETF carries a high level of risk, and is not for every investor.

Pro subscribers can read more here.

— Zavier Ong

CNBC Pro: Buy these inflation-beating funds to protect your money, strategist says

As inflation remains stubbornly high, where can investors hide out given that U.S. stocks and bonds alike have been volatile?

There are three types of funds that look appealing right now, according to Mark Jolley, global strategist at CCB International Securities. He named his favorites in each category.

CNBC Pro subscribers can read more here.

— Weizhen Tan

Goldman expects Fed funds rate at 4% to 4.25% this year

Strategists say the most important information investors are looking for from the Federal Reserve will be what's on the dot plot, the Fed's so-called interest rate forecast. After the CPI release last week, the futures market for fed funds priced a big jump higher in the terminal rate, or end point where the Fed stops hiking. It had been pricing in a 4% terminal rate by April.

"We expect the median dot to show the funds rate at 4-4.25% at end-2022, an additional hike to a peak of 4.25-4.5% in 2023, one cut in 2024 and two more in 2025, and an unchanged longer-run rate of 2.5%," Goldman Sachs' David Mericle said in a note late Sunday.

"How high will the funds rate ultimately need to go? Our answer is high enough to generate a tightening in financial conditions that imposes a drag on activity sufficient to maintain a solidly below-potential growth trajectory," he added. "We could imagine the hiking cycle extending beyond this year if additional tightening proves necessary to keep growth on a below-potential path."

— Tanaya Macheel, Patti Domm

Stocks could fall below 3,700 before the next rally, says Fundstrat's Newton

Mark Newton, head of technical analysis at Fundstrat, said investors shouldn't get too tempted by a potential bounce in the coming days as the S&P 500 could fall under 3,700 before a more meaningful rally kicks in.

"September's Triple Witching Friday close at multi-week lows is particularly negative for the prospects of a rally, and further selling still looks likely over the next couple weeks to undercut 3,700 before a relief rally can get underway in October," he said.

The S&P 500 on Friday ended the week at 3,873.33.

"While one cannot rule out a 1-2 day bounce attempt given this week's decline, I do not expect much strength until prices have reached support under 3,700 in October," he added. "Tactically, 'cash remains king' and one should be patient until markets reach downside targets, and begin to show either volume and breadth divergences, or capitulation to buy."

— Tanaya Macheel

Stock futures open little changed on Sunday night

Stock futures opened little changed on Sunday evening, after the major averages posted their worst week since June, driven largely by a hotter-than-expected inflation report and a dismal warning from FedEx about the global economy.

Futures tied to the Dow Jones Industrial Average were up by just 0.05%, while S&P 500 futures increased 0.03%. Nasdaq 100 futures were down by 0.07%.

The moves came as investors were looking ahead to the Federal Reserve's two-day September meeting, which begins Tuesday.

— Tanaya Macheel