Yesterday we went over some of the reasons why the current low interest rates are unlikely to spur a dramatic wave of refinancing activity. However, trying to capture a lower interest rate may make sense for homeowners that have equity in their property, strong credit scores and available cash. Today we’re going to run some numbers to try to quantify the benefit of a lower interest rate.

Assumptions

1. Homeowner purchased a home one year ago using a 30-year fixed mortgage at 6.5%.

2. Homeowner will refinance into another 30-year fixed mortgage at a lower interest rate.

3. Refinancing will cost $2,500 in non-recoverable closing costs.

4. Ignore taxes, insurance and PMI since they would be the same under both mortgages.

Question

Would the homeowner benefit from refinancing?

Analysis

The key to understanding if a refinancing is worthwhile is comparing the savings in the monthly mortgage payment with the up-front closing costs. As long as the monthly savings are sufficient to quickly pay off the initial investment, then the homeowner benefits. I created an Excel worksheet to compare the initial investment to the monthly savings and then use those two values to calculate how long it would take for the monthly savings to pay off the closing costs.

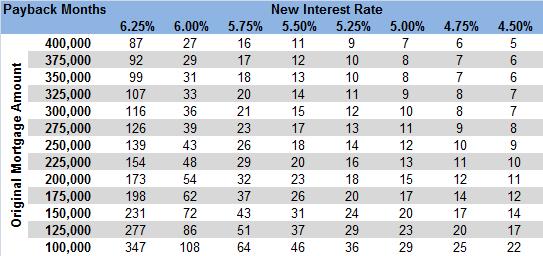

The chart above shows how many months of lower payments (savings) it would take to offset the initial $2,500 in closing costs. Each row represents a mortgage amount (not home price) and each column represents a potential new interest rate for the refinanced loan. For example, if I had taken out a $300,000 mortgage last year at 6.5%, and refinanced to a 5.25% rate, then it would take 12 months of lower payments to recover my investment in closing costs.

Discussion

The benefit of refinancing clearly depends on the size of the mortgage. Larger mortgages have higher payments, so cutting the rate means larger monthly savings. Since the closing costs are generally independent of mortgage size (assuming the lender rolls their fees into the interest rate), the payback period is shorter for larger mortgages.

We can also see that the payback time is relatively short. If you could drop your rate by 1.0% (from 6.5% to 5.5%), then you would make back the closing costs within 2 years (24 months) for mortgage amounts all the way down to $200,000. This is another way to say that refinancing would be valuable as long as you are planning to keep your current mortgage for at least 2 years.

Finally, we should also mention the option of paying points to the lender. The points can be assessed for either origination costs or as prepaid interest. Points as prepaid interest generally allow borrowers to get lower interest rates. Paying points changes the dynamic of this calculation because they should be thought of as additional closing costs. These calculations are based on mortgages with zero points.

Despite being a simplistic approach to calculating the benefit, payback is very intuitive to most homeowners. Readers with a background in finance and/or investing may be tempted to enhance the calculations to also consider the time value of money. While I concede that this calculation may slightly overstate the value of refinancing, the difference is small for most people - perhaps a month or two. The two scenarios I can imagine where the time value of money would be an issue are if you have to pass up an incredible investment opportunity to pay closing costs, or if you believe the United States is going to experience very high inflation rates. If you have inside information about either, please feel free to send it my way.

Conclusion

A quick calculation based on a likely scenario shows that there is a benefit to refinancing, and that you don’t have to live in your home forever to capture it. If you are serious about this option, it is important to work with a mortgage professional that can first confirm that you are qualified to refinance in today’s lending environment, and then can walk you through the various options. As I mentioned yesterday, Amy and I know some quality mortgage people - don’t be afraid to ask!