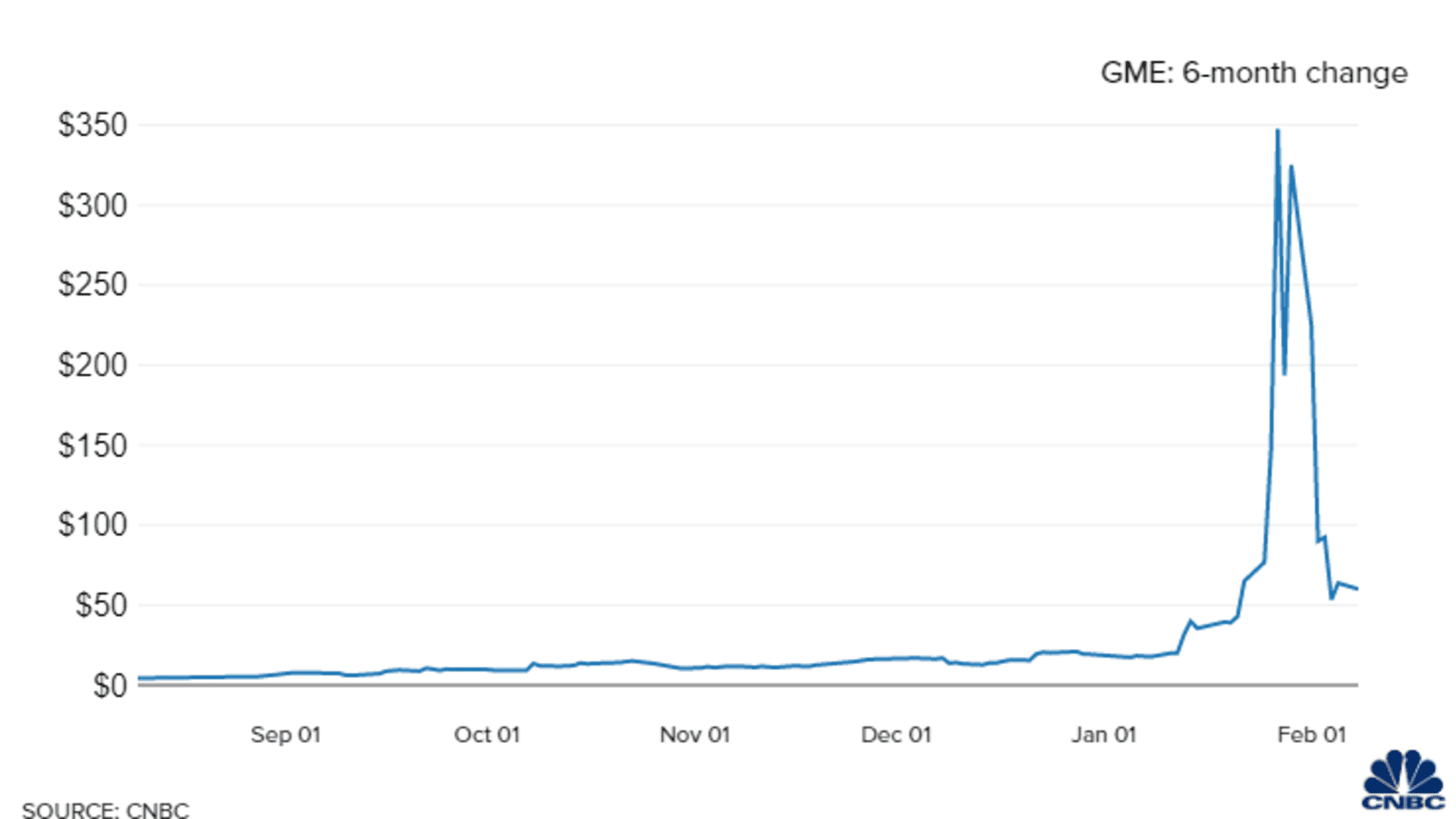

- Shares of GameStop fell more than 20% to a session low of $46.52 a share on Tuesday, following an 80% drop last week for its worst weekly performance ever.

- At its all-time high on Jan. 28, the stock was worth $483 a share.

- GameStop came into the limelight two weeks ago when an army of retail investors who coordinated trades on social media pushed the stock up 400% in just a week.

GameStop, the poster child of a recent speculative retail trading frenzy, tumbled below $50 apiece on Tuesday, as the massive short squeeze took effect and investors booked profits.

The brick-and-mortar video game retailer fell more than 20% to a session low of $46.52 a share on Tuesday, following an 80% drop last week for its worst weekly performance ever. GameStop closed Tuesday's session 16.2% lower at $50.31.

At its all-time high on Jan. 28, the stock was going for $483 a share.

GameStop came into the limelight two weeks ago when an army of retail investors who coordinated trades on Reddit's WallStreetBets forum pushed the stock up 400% in just a week. The short squeeze induced huge pain on hedge funds who bet against GameStop, while the mania forced several online brokers to limit trading in a slew of highly volatile names.

Short interest in GameStop as a percentage of shares available for trading dropped to about 50% Friday from more than 130% two weeks ago, according to data from S3 Partners. So most of the short bets have been covered and there isn't any significant force from short sellers to keep fueling the squeeze.

Money Report

Trading volume also fell sharply this week as the retail momentum slowed down.

Some on Wall Street compare GameStop's short squeeze to Volkswagen's in 2008 when the German automaker briefly became the biggest company in the world.

Other stocks that have seen heightened speculative trading activities are also unwinding. AMC Entertainment has fallen 20% this week following a 48% decline last week. Koss has dropped 11% this week and 68% in the prior week.

Wall Street breathed a sigh of relief as the frenzy turned out to be limited within a handful of names and seemed to have died down. Many had been worried that it could spill over to other areas of the market and have a more negative impact on investor confidence.

"We know financial conditions are supportive and investors have gotten more enthusiastic. ... But this does not mean the stock market is in a speculative bubble," Kristina Hooper, chief global market strategist at Invesco, said.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.