- Port delays led Hapag Lloyd, Norfolk Southern, Union Pacific and Port of Virginia to come up with a new trade model for East Coast to West Coast shipping.

- Norfolk Southern is also cutting down on container congestion by offering truck drivers incentives to drop off and pick up containers on the same trip.

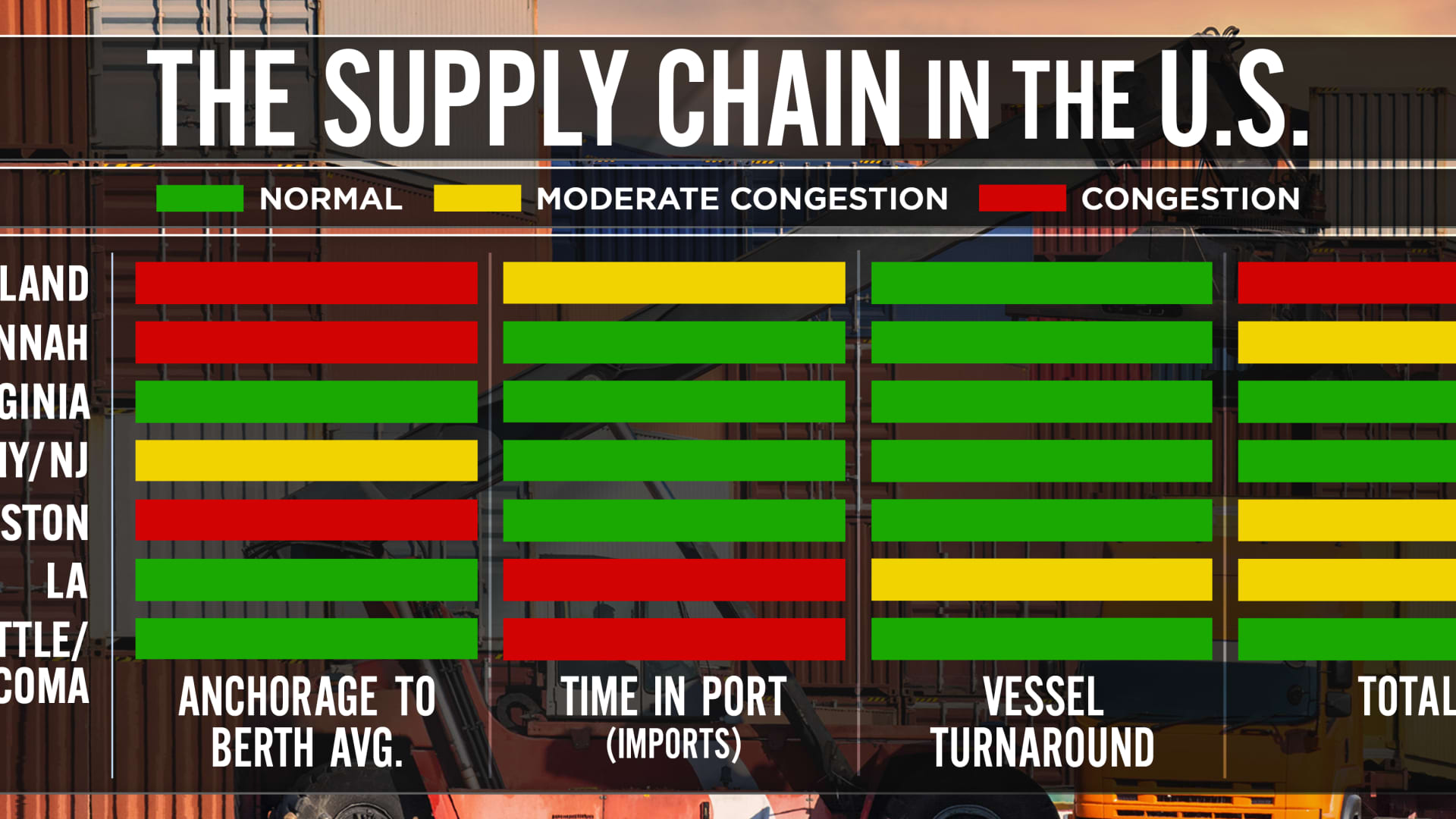

- Ports of Los Angeles and Long Beach continue to struggle with rail and truck productivity.

Ongoing rail congestion at West Coast ports has created an opportunity for East Coast ports, container shipping companies and rail operators to enter into new trade relationships.

In January, ocean carrier Hapag Lloyd, Norfolk Southern, the Port of Virginia, and Union Pacific, collaborated in creating a triangle of trade where West Coast bound freight would be brought into the Port of Virginia and loaded onto Norfolk Southern rail cars. The containers would then be loaded onto a UP railcar in Chicago bound for the West Coast.

329 medal events. 32 sports. Endless drama. Catch all the action at the Paris Olympics. Sign up for our free Olympics Headlines newsletter.

"At the end of the first quarter, we began to see the service develop," said D'Andrae Larry, group vice president of international intermodal at Norfolk Southern. "Since then we've seen that service continually grow. So the first and foremost thing was this service was accepted by the marketplace."

Larry said the idea originated with Hapag Lloyd, which was looking to move West Coast trade more efficiently.

"The market continues to think through ways to find optionality. We believe there are a lot of opportunities out there," Larry said.

Money Report

This service also moves containers West to East, enabling Union Pacific to move out its own containers. Pacific Northwest shippers say they have been using this new trade service because they can get their containers out of the Port of Virginia. They are also redirecting containers down to the Gulf ports.

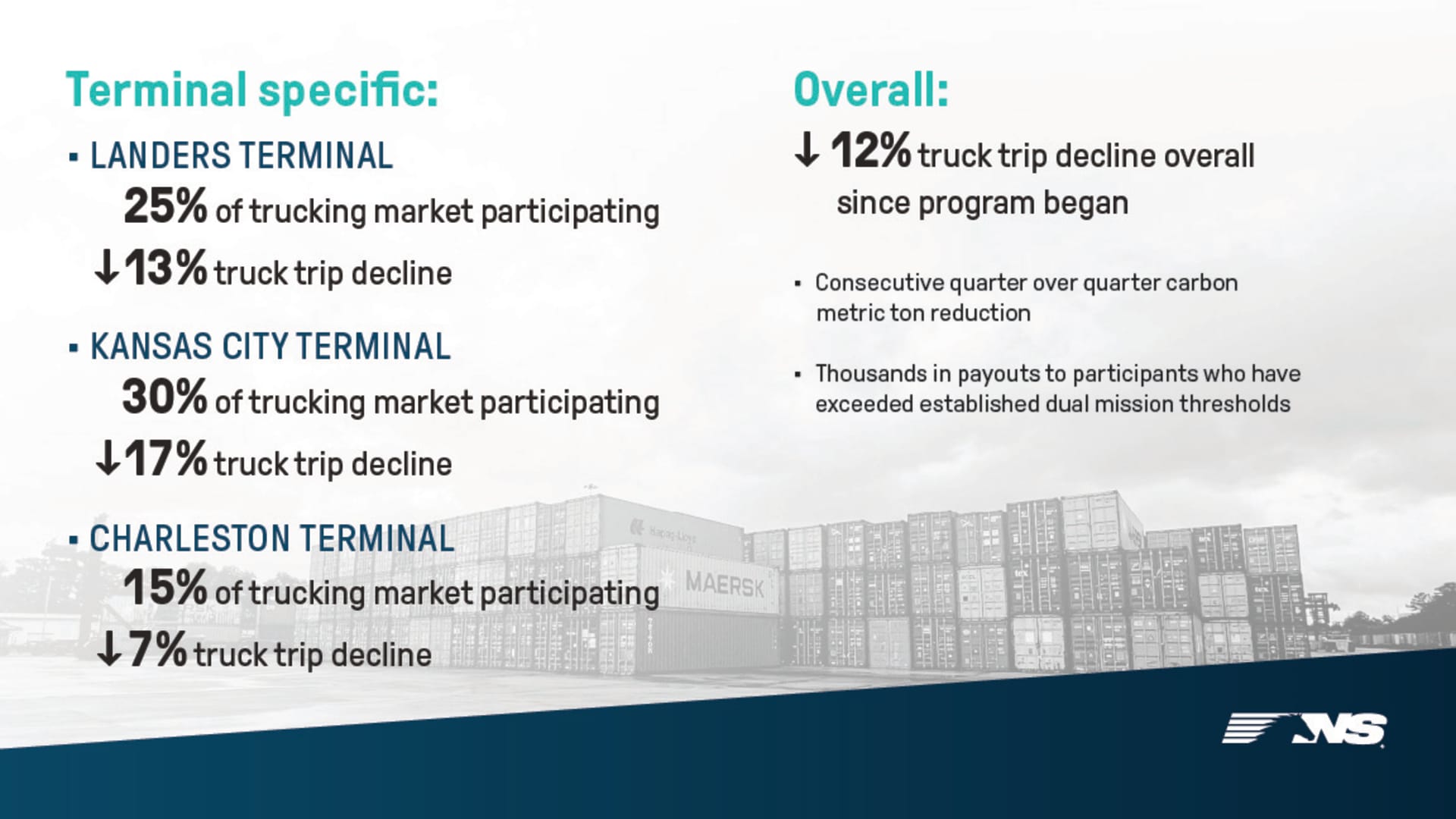

Another innovation Norfolk Southern is using to drive more balance between imports and exports is its Dual Mission rewards program, which incentivizes truckers to drop off and pick up containers in one trip. Truckers are paid a $200 incentive each time they complete a dual mission.

"The market has accepted this program," Larry said. "We hope to get to 50% or greater dual missions. We started in Chicago and Kansas City and saw more pickups. It is not just the impact of having more drivers show up at your terminal to move containers efficiently. This also helps reduce carbon in those markets because fewer trucks are on the road."

Meanwhile, the rail delays are not improving on the West Coast. Logistics managers are measuring rail delays of 12 days at the Ports of Los Angeles and Long Beach. For containers that are moved by a combination of truck and rail, delays are at 30 days. The congestion on the rails is also impacting inland rails, with delays. One logistics provider told clients the wait for a container pickup at a rail yard in Dallas is between 40-50 days. Other railyards in Kansas City and Memphis are also stacked with containers.

In an effort to relieve the gridlock at Norfolk Southern's main terminal in Memphis, the railway has opened two lots outside of the terminal to handle as many as 2,000 ocean containers.

Larry says the congestion will spur more evolution in cross-country trade routes.

"We believe that the demand for ocean freight on the East Coast will continue to be strong, and the market will continue to look for ways to serve this demand," said Larry. "As the market leads us to new lanes or new opportunities, we want to be there for that and continue to innovate new solutions," he said.

The CNBC Supply Chain Heat Map data providers are artificial intelligence and predictive analytics company Everstream Analytics; global freight booking platform Freightos, creator of the Freightos Baltic Dry Index; logistics provider OL USA; supply chain intelligence platform FreightWaves; supply chain platform Blume Global; third-party logistics provider Orient Star Group; marine analytics firm MarineTraffic; maritime visibility data company Project44; maritime transport data company MDS Transmodal UK; ocean and air freight rate benchmarking and market analytics platform Xeneta; leading provider of research and analysis Sea-Intelligence ApS; Crane Worldwide Logistics; and air, DHL Global Forwarding; freight logistics provider Seko Logistics; and Planet, provider of global, daily satellite imagery and geospatial solutions.